Pocket Option Tax Documents A Comprehensive Guide 1449010063

If you’re trading on the pocket option tax documents Pocket Option platform, it’s essential to understand the tax implications of your trading activities. This article will explore the various tax documents required for traders, how to report your earnings, and some tips to ensure you are compliant with tax regulations in your jurisdiction. Understanding your obligations can help you make informed decisions and enhance your trading experience.

Understanding Tax Obligations for Traders

Trading in financial markets, whether through forex, stocks, or cryptocurrencies, can significantly affect your tax responsibilities. When using platforms like Pocket Option, it’s crucial to keep accurate records of your trades to report your earnings accurately. Generally, earnings from trading are considered capital gains, but this may vary depending on your country of residence.

Types of Tax Documents You May Need

When preparing for tax filing, you may need several documents related to your trading activities:

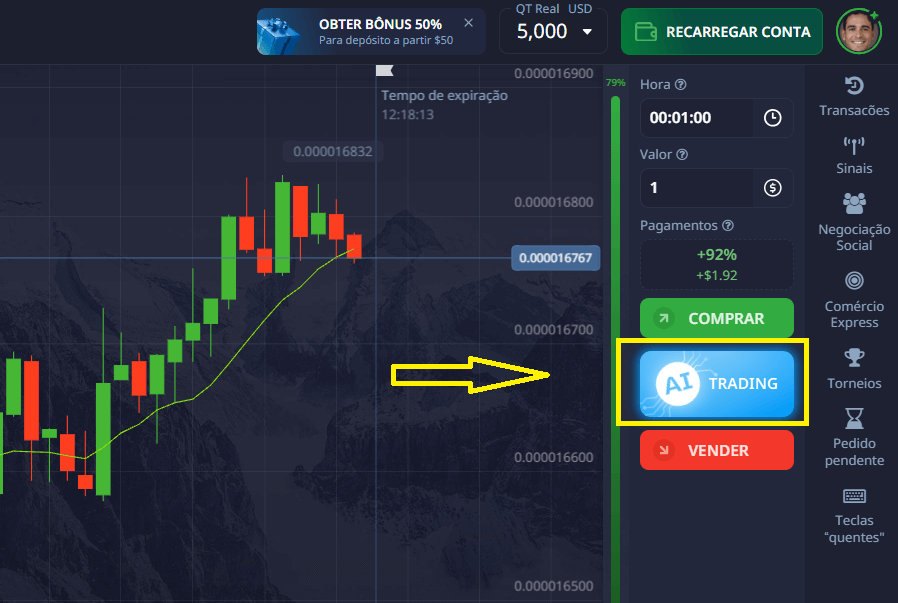

- Brokerage Statements: These are provided by Pocket Option and contain detailed records of your trades, including dates, amounts, and types of trades.

- 1099 Forms (For US Users): If you’re in the United States and your trading meets certain thresholds, you may receive a 1099 form reporting your earnings.

- Profit and Loss Statements: This statement summarizes your trading activities, helping you understand how much you earned or lost over a specific period.

- Transaction Histories: Records of all your trades can be crucial for calculating your tax liabilities.

How to Report Your Earnings

Once you have gathered all necessary documents, the next step is to report your earnings correctly:

1. Determine Your Tax Liability

Your capital gains tax can vary based on several factors, including how long you held your investments and your overall income. Short-term capital gains (investments held for less than a year) are generally taxed at a higher rate than long-term capital gains.

2. Use Appropriate Tax Software or Consult a Professional

Depending on the complexity of your trading and overall financial situation, it might be beneficial to use tax software or consult a tax professional. This ensures that you accurately report your trading activities and take advantage of any deductions.

3. Keep Detailed Records

Maintaining accurate records of your trading activities, including dates, amounts, and transaction types, is necessary. Pocket Option offers logs of trade history, which can help streamline this process.

Tips for Managing Your Trading Taxes

Here are some additional tips to help you manage your taxes as a trader effectively:

1. Stay Informed

Tax regulations can change frequently, so it’s essential to stay informed about any updates that may affect your trading taxes.

2. Separating Personal and Trading Accounts

If trading is a significant part of your income, consider keeping your trading funds separate from personal finances. This can simplify the tracking process and make it easier to prepare tax documents.

3. Utilize Deductions

Don’t forget that you may be eligible for certain deductions related to your trading activities, such as internet costs, trading software expenses, and educational materials.

Common Mistakes to Avoid

When managing your taxes as a trader, it’s easy to make mistakes. Some common pitfalls include:

1. Failing to Report All Earnings

It’s crucial not to overlook any income, as the consequences of underreporting can result in penalties.

2. Ignoring Investment Losses

While losses can be disappointing, they can also be used to offset gains. Not reporting them may lead to a higher tax bill than necessary.

Conclusion

Understanding the tax implications of trading on the Pocket Option platform is vital for successful trading and financial management. By keeping accurate records, utilizing necessary documents, and staying informed about tax regulations, you can navigate your trading taxes more effectively. When in doubt, consider consulting a tax professional to ensure compliance with your obligations and to optimize your tax situation.

By adhering to these guidelines, you can focus on what you do best—trading—while ensuring that your tax responsibilities are handled appropriately. Ultimately, this will contribute to a more successful and enjoyable trading experience.

Leave a Reply